Blog

Understanding the White Oak Impact Fund: A Guide to Sustainable Investments

The world of investing has evolved dramatically in recent years, and many investors are now looking for ways to make their investments not only profitable but also socially and environmentally responsible. One of the key players in this movement is the White Oak Impact Fund. This article will provide a comprehensive guide to understanding the White Oak Impact Fund, its goals, strategies, and how it is making a difference in the world of sustainable investments.

What is the White Oak Impact Fund?

The White Oak Impact Fund is an investment fund managed by White Oak Global Advisors, an investment management firm based in San Francisco, California. The fund focuses on impact investing, which seeks to generate positive social and environmental outcomes alongside financial returns. Unlike traditional investments, impact investing aims to achieve measurable benefits that contribute to a better world, such as supporting clean energy, affordable housing, and sustainable agriculture.

The fund primarily targets sectors that align with its social and environmental goals, including renewable energy, healthcare, education, and affordable housing. By focusing on these sectors, the White Oak Impact Fund hopes to help create a sustainable and inclusive future for communities around the world.

White Oak Global Advisors: The Firm Behind the Fund

Before diving into the specifics of the White Oak Impact Fund, it’s essential to understand the firm behind it. White Oak Global Advisors was founded with the vision of combining financial returns with positive social impact. The firm is known for its expertise in direct lending and impact investing and has a strong track record of helping its clients achieve both financial and social returns.

White Oak’s approach to impact investing is rooted in the belief that financial success and positive societal change can go hand in hand. This philosophy is reflected in the White Oak Impact Fund’s investment strategy, which emphasizes long-term value creation and measurable impact.

Key Features of the White Oak Impact Fund

1. Impact Focused Investments

At the core of the White Oak Impact Fund is its commitment to making investments that lead to positive outcomes. The fund’s investment strategy prioritizes sectors that contribute to environmental sustainability, social equity, and community development. Some of the key focus areas include:

- Renewable Energy: Investing in clean energy projects that reduce reliance on fossil fuels and mitigate climate change.

- Healthcare: Supporting initiatives that improve access to quality healthcare services, particularly in underserved communities.

- Education: Funding projects that increase educational opportunities and improve outcomes for students in low-income areas.

- Affordable Housing: Investing in housing projects that provide safe and affordable living spaces for people in need.

By focusing on these areas, the White Oak Impact Fund aims to generate both financial returns and lasting positive change.

2. Environmental, Social, and Governance (ESG) Criteria

The White Oak Impact Fund applies strict Environmental, Social, and Governance (ESG) criteria when selecting investments. ESG factors are critical in ensuring that investments align with the fund’s values and contribute to sustainable development. These criteria help the fund assess the long-term viability of its investments and ensure they meet high ethical standards.

- Environmental: The fund considers the environmental impact of its investments, such as carbon emissions, energy efficiency, and resource conservation.

- Social: The fund evaluates the social impact of its investments, focusing on issues such as labor practices, community development, and access to essential services.

- Governance: The fund looks at the governance structures of potential investments, ensuring they adhere to strong corporate governance practices and ethical standards.

3. Active Management

White Oak Impact Fund takes an active management approach to its investments, meaning that the fund’s managers work closely with portfolio companies to ensure they are meeting their impact and financial goals. This hands-on approach helps maximize the potential for success and ensures that investments continue to deliver both financial and social returns over the long term.

The fund’s managers regularly assess the performance of their investments, monitor progress toward impact goals, and make adjustments as needed to ensure that the fund’s objectives are being met.

4. Measurable Impact

One of the defining features of the White Oak Impact Fund is its focus on measurable impact. The fund uses a variety of tools and frameworks to track the social and environmental outcomes of its investments. These include metrics related to energy savings, job creation, education outcomes, and healthcare access.

By tracking these metrics, the fund can ensure that its investments are not only generating financial returns but also delivering tangible benefits to society and the environment.

How the White Oak Impact Fund Operates

The White Oak Impact Fund operates through a combination of direct lending and equity investments. The fund typically invests in companies and projects that align with its impact objectives and are well-positioned to generate both financial returns and positive societal outcomes.

Investments are made across a range of sectors, with a particular focus on projects that have the potential to scale and create significant impact. The fund’s investment strategy includes:

- Direct Lending: Providing loans to companies that meet the fund’s impact criteria. These loans are often used to finance projects in sectors such as renewable energy and affordable housing.

- Equity Investments: Investing in companies that align with the fund’s values and have the potential for long-term growth and impact.

By using a combination of direct lending and equity investments, the White Oak Impact Fund aims to diversify its portfolio and mitigate risk while still achieving its impact goals.

Success Stories of the White Oak Impact Fund

The White Oak Impact Fund has already seen considerable success in several key sectors. Some of its notable achievements include:

- Job Creation: Many of the fund’s investments have resulted in the creation of new jobs, particularly in communities that have been economically disadvantaged. For example, investments in renewable energy projects have led to the creation of green jobs in areas like solar energy installation and wind turbine maintenance.

- Greenhouse Gas Emission Reductions: The fund’s investments in clean energy projects have contributed to significant reductions in greenhouse gas emissions. These projects include solar farms, wind energy projects, and energy-efficient buildings.

- Affordable Housing: The fund has also made investments in affordable housing projects, providing safe and affordable living spaces for thousands of people in need.

These successes demonstrate the potential of impact investing to generate both financial returns and positive social outcomes.

The Future of the White Oak Impact Fund

Looking ahead, the White Oak Impact Fund is committed to continuing its mission of combining financial success with positive social and environmental change. The fund will continue to focus on high-impact sectors such as renewable energy, healthcare, education, and affordable housing, and it will seek out new opportunities to drive positive change.

The fund’s focus on measurable impact, active management, and ESG criteria will ensure that it remains a leader in the field of impact investing. As more investors seek out ways to make their investments align with their values, the White Oak Impact Fund is well-positioned to meet this growing demand and continue its work in creating a more sustainable and equitable world.

10 Frequently Asked Questions

- What is the White Oak Impact Fund? The White Oak Impact Fund is an investment fund that focuses on generating positive social and environmental outcomes alongside financial returns. It invests in sectors like renewable energy, healthcare, and affordable housing.

- Who manages the White Oak Impact Fund? The fund is managed by White Oak Global Advisors, a San Francisco-based investment management firm.

- What are the main sectors the fund invests in? The fund invests in renewable energy, healthcare, education, and affordable housing, aiming to create positive social and environmental impacts.

- What is impact investing? Impact investing involves making investments that generate both financial returns and measurable social or environmental benefits.

- How does the White Oak Impact Fund measure impact? The fund uses various metrics, such as job creation, energy savings, and improvements in healthcare access, to measure the impact of its investments.

- What is ESG investing? ESG stands for Environmental, Social, and Governance. ESG investing focuses on selecting investments based on these criteria to ensure ethical and sustainable practices.

- How does the White Oak Impact Fund ensure financial success? The fund employs active management, carefully selecting investments and working closely with portfolio companies to ensure they meet both financial and impact goals.

- Is the White Oak Impact Fund open to all investors? The White Oak Impact Fund typically caters to institutional investors and accredited individuals who meet certain financial criteria.

- Can the White Oak Impact Fund help fight climate change? Yes, the fund’s investments in renewable energy projects contribute to reducing greenhouse gas emissions and fighting climate change.

- What is the future of the White Oak Impact Fund? The fund plans to continue its work in sustainable investments, focusing on expanding its portfolio in sectors that align with its impact goals.

Read More: Muse Scroll

-

Celebrity3 weeks ago

Celebrity3 weeks agoRoan Howard Cassidy? The Unique Story of Shaun Cassidy’s Son

-

Celebrity4 weeks ago

Celebrity4 weeks agoWho is Pat McConaughey? The Unique Story of Matthew McConaughey’s Brother

-

Celebrity3 weeks ago

Celebrity3 weeks agoDeidre Angela Shaw? The Unique Story of Angela Lansbury’s Daughter

-

Celebrity3 weeks ago

Celebrity3 weeks agoHarper Vedder? The unique Story of Eddie Vedder’s Daughter

-

Celebrity3 weeks ago

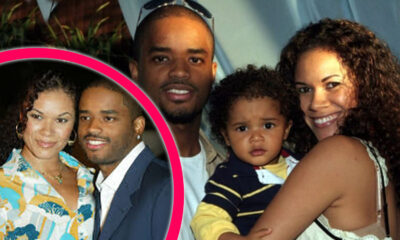

Celebrity3 weeks agoMiles Xavier Tate? The Unique Story of Larenz Tate’s Eldest Son

-

Celebrity3 weeks ago

Celebrity3 weeks agoLesa Tureaud? The Unique Story of Mr. T’s Daughter

-

Celebrity2 weeks ago

Celebrity2 weeks agoJessie Phoenix Jopling? The Unique Story of Sam Taylor-Johnson’s Daughter

-

Celebrity2 weeks ago

Celebrity2 weeks agoNavy Talia Nash? The Unique Story of Nivea’s Daughter